Ebitda margin calculation

Calculation begins at the end number of the income or net statement. The first one is based on net income such that.

EBITDA margin is a measure of a companys profitability calculated as EBITDA.

. For example an average EBITDAsales margin for the advertising. Unlike the first formula. EBITDA can be calculated using a series of formulas.

You can format your EBITDA as a percentage to make it easier to compare to the margins of your competitors. EBITDA Net Income Taxes Interest Expense Depreciation Amortization. Once you have the EBITDA of a company you can find the EBITDA margin calculation formula as under.

Baca Juga

The EBITDA Margin Calculator is used to calculate the EBITDA margin. If starting with the net income you. The formula for calculating EBITDA.

Divide by total revenue. To find your EBITDA margin percentage. EBITDA margin EBITDASales100.

It is equal to earnings before interest tax depreciation and. EBITDA Net Income Interest Taxes Depreciation. EBITDA Margin is calculated using the formula given below.

EBITDA Net Income Interest Taxes Depreciation Amortization. First calculate Walmart Incs EBITDA margin for the year 2018. EBITDA Margin Total Sales COGS Operating.

The operating margin and net income margin of the companies are impacted by their different DA. Applying the formula is as follows we calculate. Using the formula as above EBITDA of the.

By adding back the interest taxes depreciation and amortization expenses we can figure out EBITDA of the company. One of the most commonly used metrics in analyzing the financials of a company is the EBITDA or the Earnings before Interest Taxes Depreciation and. EBITDA Margin 40m 100m 400.

EBITDA Net Income Interest Taxes. Using Net Income. Below is an EBITDA margin calculator to compute earnings before interest expenses taxes depreciation and amortization margin.

You can calculate EBITDA margin of both companies as follows. To know if an EBITDA multiple is good you must look at it compared to other similar types of businesses. EBITDA margin 1800000 200000 10000000 20.

EBITDA margin is a measurement of a companys operating profitability as a percentage of its total revenue. EBITDA margin is a profitability ratio to measure how much a company profits from recorded revenue after adjusting for non-cash items but before paying interest and. Enter a companys net earnings interest expenses.

The second formula for calculating EBITDA is.

Ebitda Types And Components Examples And Advantages Of Ebitda

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

What Is Ebitda Formula Example Margin Calculation Explanation

Ebitda Margin Definition Example Investinganswers

What Is Ebitda Formula Example Margin Calculation Explanation

How Do I Calculate An Ebitda Margin Using Excel

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Formula Meaning Interpretation With Examples

Full Ebitda Guide What Is It How Investors Use It Formula

Ebitda Margin Template Download Free Excel Template

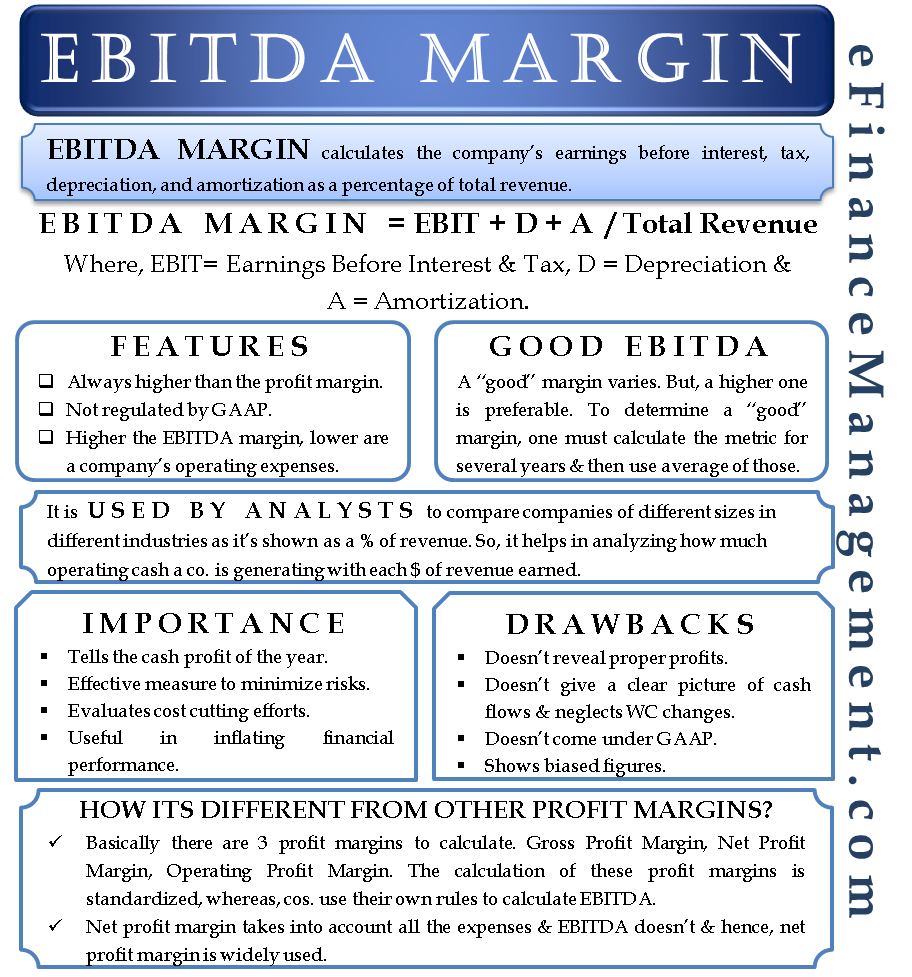

Ebitda Margin Features Importance Drawbacks Other Profit Margins

Ebitda Margin Formula And Calculator Excel Template

Ebitda To Interest Coverage Ratio Definition

How To Calculate Ebitda Margin

What Is Ebitda Formula Definition And Explanation

Ebitda Margins What Every Small Company Owner Needs To Know

Ebitda Margin Formula And Calculator Excel Template